[dc]A[/dc]s part of the final push to enact tax reform before the end of the year, a proposed tax code change that would permit churches and other non-profit organizations to engage in partisan political campaigning has been dropped from the House and Senate reconciliation version of 2017 tax bill. Although the House version of the bill had included a repeal of the controversial Johnson Amendment, the Senate version kept it intact. Proponents of the repeal have argued for the right of pastors to speak freely about candidates from the pulpit, and opponents claim it would provide a “dark money” tax-exempt way to launder otherwise non-tax deductible campaign donations.

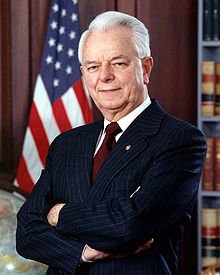

It appears that the Democrats invoked the “Byrd rule” enacted in 1990 as part of the Congressional Budget Act which states that reconciliation tax bills cannot contain “extraneous” provisions not related to federal revenue and spending. The Byrd rule, named after the late senator from West Virginia, Robert Byrd, was previously invoked to block an attempt to repeal Obamacare as earlier this year.

The way this works is that it normally requires a simple majority in the Senate to pass a tax bill, which the Republicans have. However, if a bill includes “extraneous” provisions, any senator can offer an amendment to remove these provisions per the Byrd rule or raise a “point of order” which requires 60 votes to overcome. (See Bloomberg for more information.)

In this case, it could easily be argued that a repeal of the Johnson Amendment is “extraneous” to federal revenue and spending, and a senator could raise a “point of order” invoking the Byrd rule and requiring that the issue be voted on. Given the split in the Senate, it would be impossible for the 51 Republicans to get 9 more Democrats to join them in order to overcome the objection. So, as a matter of political pragmatism, the repeal has been dropped from the tax reform bill.

In a May 4, 2017, executive order, President Trump ordered that the IRS limit enforcement of the Johnson Amendment “to the extent permitted by law.” This order did not alter the Johnson Amendment, but simply explained the scope of its reach.

Non-profit religious organizations remain free to speak to the moral or political issues of the day without fear of losing their tax-exempt status. The only thing they cannot do is engage in direct campaigning on behalf of or against particular candidates.

Congress may introduce a repeal of the Johnson Amendment in separate legislation in the near future, but it will need to be addressed separately.