LA County recognizes churches are constitutionally exempt from stay-at-home order

The language of the new Los Angeles COVID restriction specifically exempts religious gatherings as a matter of constitutional…

The language of the new Los Angeles COVID restriction specifically exempts religious gatherings as a matter of constitutional…

The Satanic Temple is asserting a free exercise right to abortion as a religious ritual in lawsuits against…

Contempt of court is a quasi-criminal act, and the court cannot punish someone for breaking a regulation if…

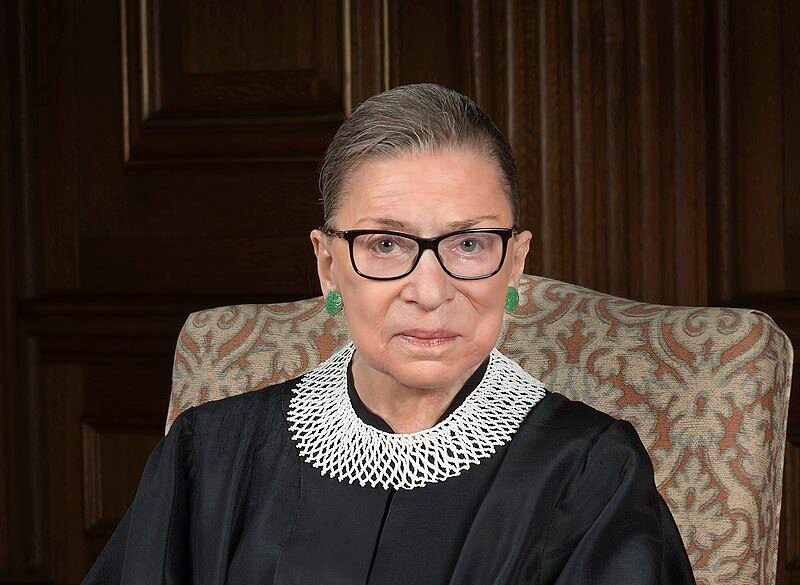

Ginsburg wrote little on the religion clauses, but she frequently joined with those Justices who favored a strong…

The ethical and moral onus is now on religious institutions as they decide whether to fire "ministerial" employees…

With the death of state Blaine Amendments this week, religious schools that welcome state money might find that…

The Kentucky Supreme Court has ruled that an organization that sued Hands On Originals ("Hands On"), a t-shirt…

The United States (U.S.) Supreme Court agreed to hear a case, Espinoza v. Montana Dept. of Revenue, concerning a…

There's an old adage that bad facts make bad law, and in this case, given political exigencies, there…

In ruling that an unwritten rule, quite possibly manufactured after the execution was already scheduled, should not be…