Silver is ripping through the financial jungle, and the herd is spooked. This isn’t just a bull run. It’s a stampede in a minefield.

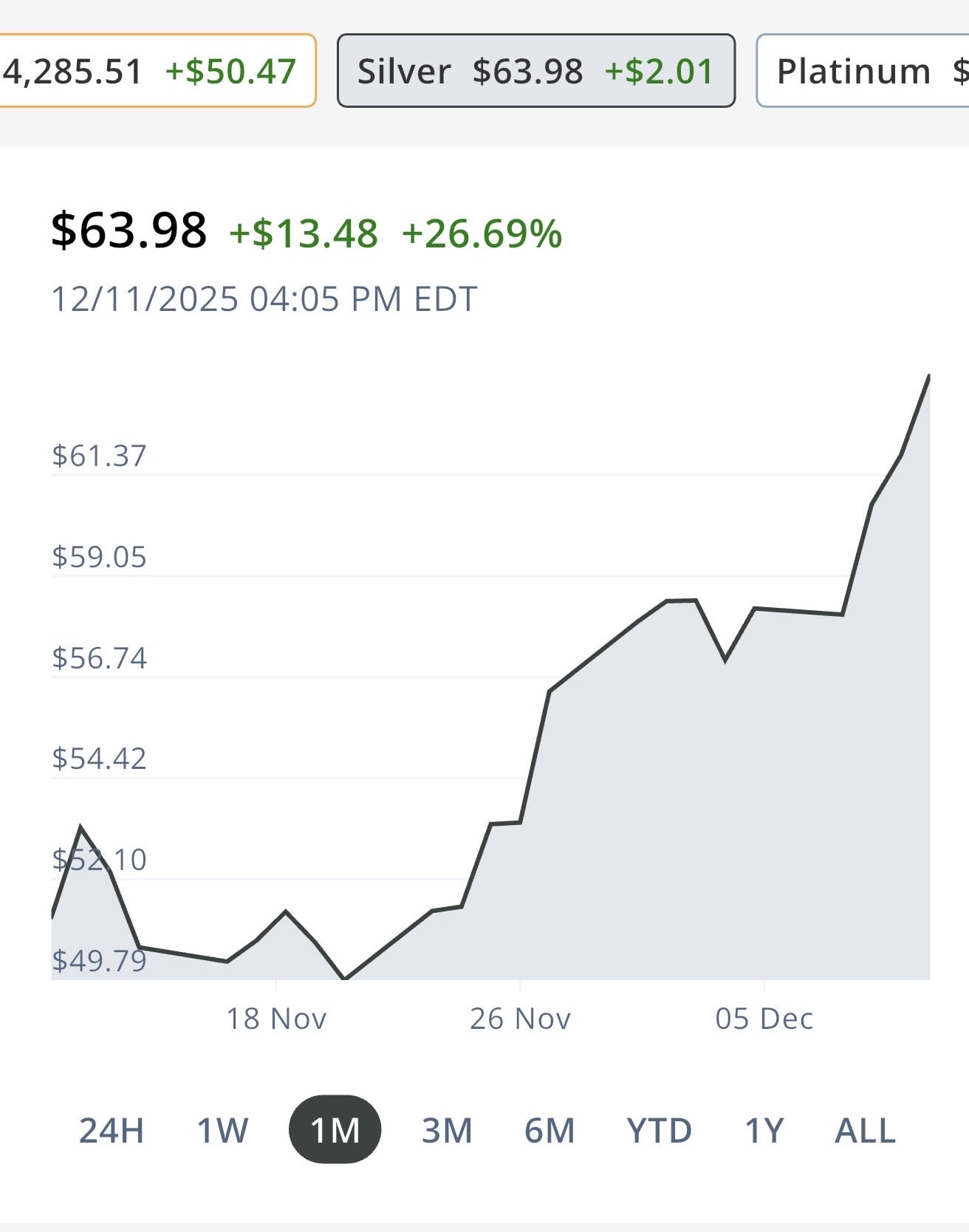

Chart from JM Bullion 12/11/2025

There’s blood in the ticker tape and fire in the eyes of traders who haven’t slept since Halloween. Silver, that ancient, underdog cousin of gold, has burst through $60, then $63, now flirting with $65 like a bar brawler looking for a fight. This isn’t just about shiny coins or fancy jewelry. This is a raw economic pulse, pounding through the walls of the American market machine.

If you listen close, you can hear the hum of solar panels and EV circuits sucking silver like oxygen while the Fed flips a coin on interest rates. One more cut and the dollar starts to wheeze. Meanwhile, the miners, most of whom don’t even mine silver directly, are chasing ghosts through rock just to keep up with demand. You can’t just conjure more silver. You either dig it out of the earth or melt it from the scrap heap.

The U.S. economy, with its jittery growth, its “soft landing” whisper campaign, and its humming data dashboards, now has to reckon with the brutal fact that silver isn’t waiting for policy announcements. It’s already moving. Fast. And not because some day-trading Reddit crew decided to run it up for the meme.

This time, it’s real.

Silver, half-industrial workhorse and half-financial safehouse, is riding high on two jet engines: fear and need. Fear from investors looking for shelter from an uncertain Fed, an overheating tech market, and a world unraveling at the seams. And need from industries building solar grids, electric vehicles, satellites. These are the guts of 21st-century infrastructure. You can’t print silver. You can’t fake it. And right now, you can’t get enough of it.

The current price spike reflects more than just speculation. It’s rooted in structural issues. Global supply has failed to meet demand for several consecutive years, and there is no quick fix. Most silver isn’t mined on purpose. It’s pulled out of the ground while chasing other metals like copper, lead, and zinc. That makes rapid production increases nearly impossible. This isn’t like oil, where you can turn on the taps if prices go high enough. With silver, you’re stuck with what the rock gives you.

Wall Street suits are hedging their exposure, watching silver futures like a man sweating at a blackjack table. The more silver rises, the more it says something’s off in the system. A commodity this grounded in manufacturing shouldn’t be a darling of speculators unless something’s about to snap.

At the same time, Main Street manufacturers are chewing antacids, calculating costs, and wondering if those sleek green dreams are about to get a lot more expensive. Solar panel builders, chipmakers, and EV startups all run on silver. Push the price past what their spreadsheets can handle, and the whole supply chain staggers.

If silver becomes a bottleneck, Washington may be forced to act. No one’s proposing a strategic silver reserve, but if clean energy developers start sounding the alarm, Congress could look at tax credits or import incentives. Silver’s not a national security issue yet. But if supply tightens further and industrial users start cutting production, the pressure will build.

The Federal Reserve may also start to feel boxed in. If silver continues to climb while inflation softens in other areas, it complicates their narrative. Commodity inflation is political dynamite. You can’t tell voters inflation is easing when the cost of wiring a solar array just doubled. Every basis point in interest rates now has a chain reaction in real assets.

Don’t expect the SEC to jump in. There’s no evidence of manipulation. The CFTC might look at trading patterns if things get wild, but this isn’t 2021. The rally isn’t coming from meme traders or short squeezes. It’s old-fashioned demand crashing into real scarcity.

Back in the dark guts of the exchange floors, the old traders will tell you silver always does this. “Volatile,” they mutter like it’s a curse. But this isn’t the usual swing. This is silver grabbing the wheel and flooring it through every guardrail of economic orthodoxy.

And if it crashes? We all go with it.

Silver is no longer just metal. It’s a signal. A warning. Maybe even a prophecy. And the real question isn’t whether it’ll keep climbing. The real question is what happens to everything else when it does.

Watch the metal. It’ll tell you what the market won’t.

TLDR (Too Long / Didn’t Read Summary)

Silver prices have climbed past $63 per ounce in December 2025, driven by industrial demand, Federal Reserve policy expectations, and persistent supply deficits. The U.S. economy faces ripple effects as clean energy and tech industries absorb rising input costs, and policymakers watch the metal’s movement for signs of deeper economic stress. Analysts say this rally reflects real market tightness, not short-term speculation.

Like this article? Share it and subscribe to ReligiousLiberty.TV for breaking updates on market trends, court rulings, and policy shifts. Stay informed with early access to in-depth analysis.

AI Disclaimer

This article was prepared with the help of artificial intelligence and reviewed for factual accuracy. It does not constitute legal or financial advice. Please consult a licensed attorney or investment advisor about your specific situation.

SEO Tags: silver prices 2025, silver shortage U.S., industrial silver demand, Fed interest rate silver, commodity market inflation

Source: ReligiousLibertyTV on Substack